Start loan requests through QLO or any external channel and collect customer data and documents or retrieve them from your connected systems, all in one place.

QUALCO LOAN ORIGINATOR

Smarter Lending Starts Here

Launch, assess and approve loans fast, across any channel. QUALCO Loan Originator (QLO) is your flexible, data-driven platform for:

- Automated decisioning workflows

- Faster approvals

- Rapid loan product launches

- Lower credit risk

Lending That Moves at Your Speed

Cut time, reduce costs, and improve the lending experience for your customers.

4 minutes

From Application to Approval

Achieve full loan origination in minutes.

40% Up to

Lower Origination Costs

Automate decisions and reduce manual work.

Higher Satisfaction

Give borrowers the experience they expect.

LOAN ORIGINATION SOFTWARE

Lending Evolves.

Your Process Should Too.

Modern lending is no longer about what you offer, it’s about how efficiently you deliver. Whether you serve retail customers, SMEs, or embed credit into digital journeys, QLO modernises your origination process without disrupting what works.

QLO simplifies lending by:

- Digitising the entire loan origination journey

- Automating KYC, documentation and regulatory compliance

- Applying policy-based decisioning

- Connecting systems, teams and channels

WHAT SETS QLO APART

Built for Speed, Designed for Control

Empower your team to move fast, make smart decisions, and stay compliant,

with no development required.

-

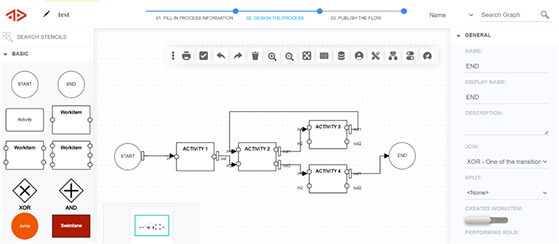

Process Designer

Design loan origination processes end to end, using an intuitive visual builder to define activities, user roles, access levels, business rules, and variables.

-

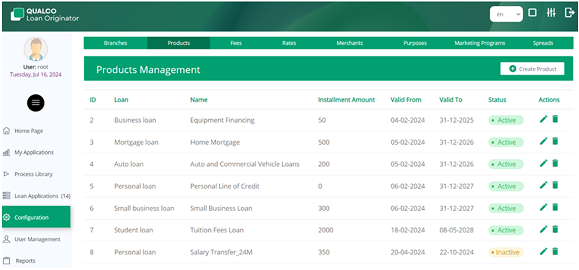

Product Configurator

Develop and manage new loan products by setting key requirements such as interest rates, fees, collateral rules, and eligibility criteria, all within one interface.

-

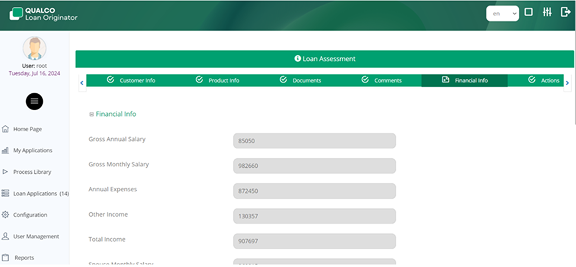

Credit Officer View

Enable credit officers to make informed decisions with a unified 360° customer profile, including external data from credit bureaus, registries, and system-generated scores.

-

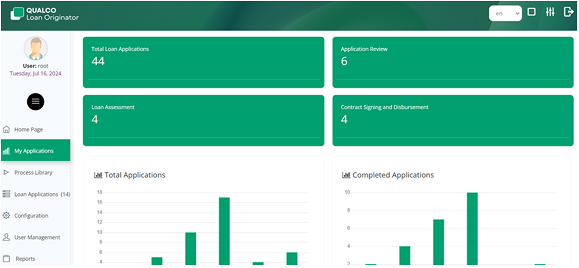

Reporting Dashboards

Track business performance and KPIs down to the task level. Identify bottlenecks, monitor productivity, and support strategic improvements with real-time insights.

A SMARTER LENDING JOURNEY

From Application to Approval, Without Delays

QLO streamlines each step of origination, while keeping your team in control.

Interactive Demo

See how QLO works step by step

- Explore hands-on platform walkthroughs.

- Follow each process at your own pace.