- Solution Playback

- Requirement Validation

- Training

QUALCO Collections & Recoveries Accelerator

The Smart Way to

Accelerate Early Collections

A ready-to-deploy solution for small to medium-sized retail banks and lenders, designed to streamline early-stage collections through automation, fast ROI and minimal IT effort.

- Achieve fast ROI

- Go-live in weeks

- Integrate seamlessly

- Scale with add-on capabilities

Why QCR Accelerator

Designed for unsecured lending portfolios, QCR Accelerator combines a built-in decision engine with pre-parameterised segmentation and a rapid deployment model. It enables medium-sized retail banks and lenders to become fully operational within weeks and quickly achieve results.

13 weeks

to go-live

100% ROI

in 7-8 months

Pre-Configured

Capabilities

for fast deployment

Out-of-the-Box Features

Say Goodbye to Manual Processes

With a Suite of Pre-Configured Tools

-

Data Structure & Roles

Simplify customer, contact, and case data management with predefined file integrations, enabling rapid deployment.

-

Pre-configured Segmentation

Manage cases effectively with automated segmentation and tailored treatments, ensuring consistency across all processes.

-

Strategies & Worklists

Build, customise, and adapt strategies to meet business needs. Manual worklists ensure efficient handling of exceptions.

-

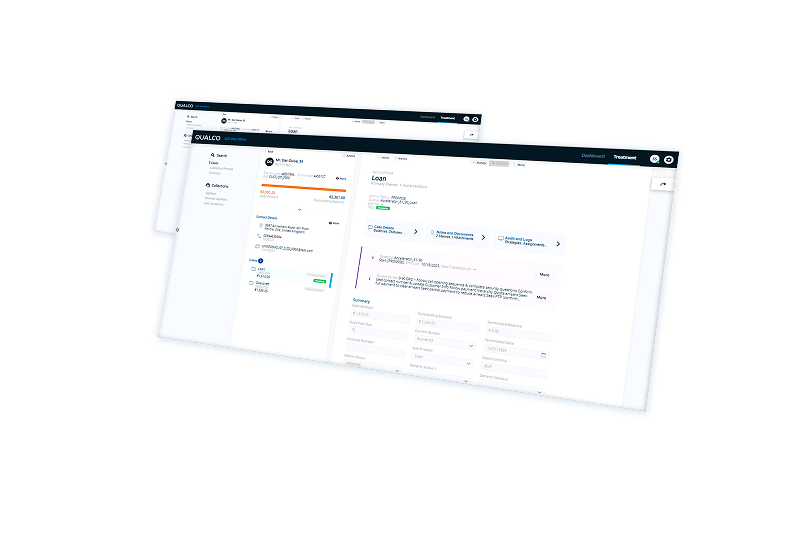

Best-in-class UI

Use our intuitive, web-based interface for faster user adoption and enhanced productivity.

-

Integrated Decisioning

Optimise case outcomes with an advanced decision engine using customer data and pre-built rules.

-

Treatment Mechanism

Receive a treatment mechanism which can be easily adapted to your specific needs. Exception Monitoring, Payment Plans, and Delinquency Statuses are already pre-configured.

-

Contact Templates

Send tailored, template-based communications to customer segments, enhancing outreach efficiency.

How it works

Explore Our 3-step Approach

to Rapid Deployment

Frequently Asked Questions

-

Who can benefit from the QUALCO Collections & Recoveries (QCR) Accelerator?

-

How does the Accelerator handle collections cases?

-

Can the solution be customised to my organisation’s needs?

-

What pre-configured roles are available?

-

How does the QCR Accelerator integrate with existing systems?

-

Is the solution scalable for future needs?

-

What kind of training and support does QUALCO provide?